About 2 weeks ago, I received a marketing email from Unionbank—inviting their account holders to join their Bonds investing app called BondsPH. I know little things about investments but I am always interested in financial freedom.

Despite my interest in personal finances, I’ve never taken any serious investments especially with these types of investments where you put your money to work. The reason is—first, I don’t have much money to invest. Second, I don’t have emergency funds to be confident with taking risks and lastly, I have a lot of liabilities to pay.

Investing also requires so much time in studying and analyzing how it exactly works, otherwise people fail with it. I just don’t find it exciting like building businesses or projects to make money.

However, this email by Unionbank about Premyo Bonds caught my attention somehow. So I told, my self—why not give it a try.

So in this post, I’ll share with you the details of what is Premyo Bonds, how to subscribe to this investment and all other things I found about this bonds investment. It may be long but I’ll make sure that you’ll leave this post with no further questions. Char lang. Please follow my blog and my social media accounts to show some love. 🥰

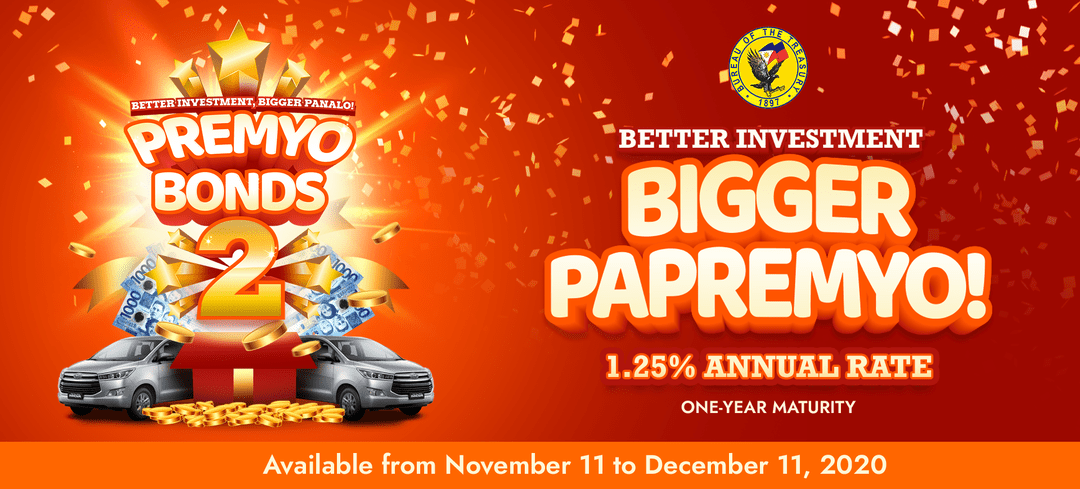

What is Premyo Bonds 2?

Okay. This is where we start. Premyo Bonds is a type of Bond investment with BondsPH. There are other banks that offer Premyo Bonds but BondsPH app is basically the easiest platform to get started with. It’s also available for a limited-time only.

A bond is a fixed income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental)

According to Investopedia

If you invest in Bonds, it’s like you are lending your money to the corporate or government (and with Premyo Bonds it’s for the Government.). It’s a low-risk type of investment because whatever happens, the Government is required to provide the investors with the money and income that has been agreed.

This is a safe and guaranteed way to invest money, but don’t expect too much. I’ll tell you why in a bit.

Premyo bonds investment is actually being promoted by the Bureau of Treasury. To be honest I am not sure if all bonds are supposed to be promoted by the said bureau but that is what it is for Premyo Bonds.

Premyo Bonds is Different from other Bond investment

What makes Premyo Bonds 2 different from any other bond investment is that they really have Premyo(Prizes). For every 500PHP(which is also the minimum investment amount) that you invest in Premyo Bonds 2, you get one raffle entry for their draw. And they also mentioned that if you have a 20,000 PHP investment you also get a chance to win 50,000 PHP quarterly. I honestly, don’t know when the raffle happens but probably after the maturity date of your investment.

As per their video ads below you can win a car, house, condo and huge things like that. But on this PDF file I found on treasury.gov.ph it is cash rewards and Car.